Check Your Rates

Calculate Your Eligbility from the loan Calculator

Calculate Your Eligbility from the loan Calculator

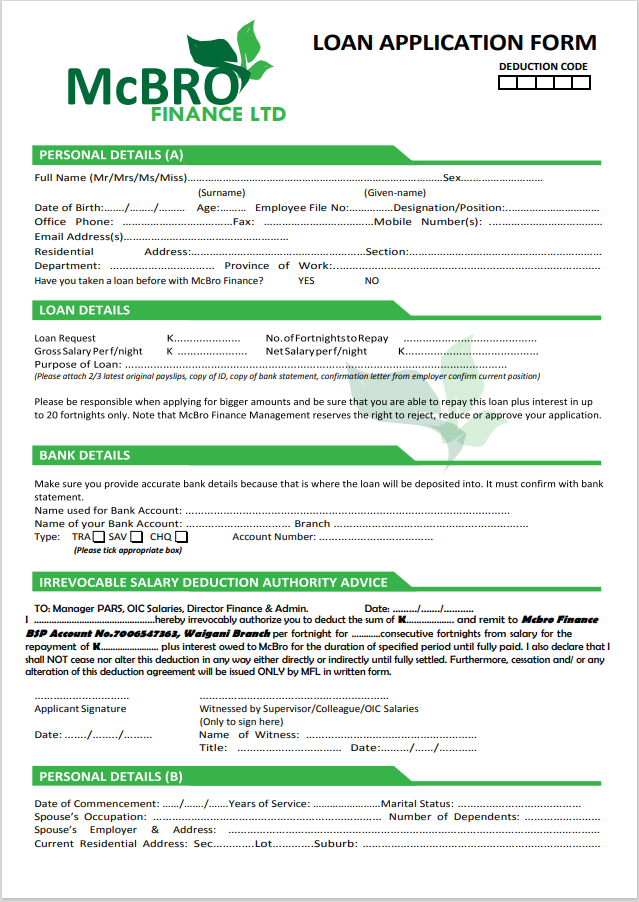

You can click on this link to fill in the from online or Download the application form and send it on our email address

“Attach three latest payslips” means you’re being asked to provide copies of your three most recent payslips. A payslip is a document provided by your employer that outlines your earnings, deductions, taxes, and other relevant financial information for a specific pay period.

A confirmation letter, in the context of employment, is a formal document provided by your employer that confirms your employment status, including details such as your job title, start date, salary or compensation, and any other relevant terms and conditions of your employment.

Click on the button now to apply for your loan online or send us an email .

To be loyal, trustworthy, and an outstanding financial institution within banking and finance industry.

We will be the preferred provider of targeted financial service in our chosen markets based on strong customer relationships. We will strengthen these relationships by providing right solutions.

Our goal is to create customer loyalty, shareholder value, and employee satisfaction.

Mimium Personal loan is K500

MCBRO offers a flexible range of repayment options, and you can choose a repayment term that suits your financial situation. You can repay the loan within a minimum of 1 fortnight (2 weeks) or extend the repayment period to a maximum of 52 fortnights (1 year).

Approved customers with a stronger credit profile or financial stability may be eligible for extended repayment periods on their loans, allowing them to have more time to repay the loan and lower monthly installments.

By signing and submitting the completed loan application form, you are formally requesting a loan from the lender, and MCBRO will review your application to assess your eligibility and creditworthiness. It’s essential to provide accurate information and ensure you understand all the terms of the loan before proceeding. Once your application is processed and approved, the lender will communicate the loan offer, and if you agree to the terms, the loan amount will be disbursed to you as specified in the loan agreement.

Bring to the table win-win survival strategies to ensure proactive domination. At the end of the day, going forward, a new normal that has evolved from generation X is on the runway heading towards a streamlined cloud solution. User generated content in real-time will have multiple touchpoints for offshoring.

the borrower has completed a form that allows their employer to deduct loan repayments directly from their salary and authorizes the lender to verify their salary information with the employer to assess their ability to repay the loan. The document has also been stamped and signed by the HR or Payroll Officer in Charge (OIC) to signify their acknowledgment and agreement to implement the salary deduction as per the terms of the loan agreement

it’s important to note that the specific identification documents requested or accepted may vary based on the institution’s policies, local regulations, and the purpose for which the identification is needed. When providing copies of identification documents, it’s essential to be cautious and ensure that you are sharing these documents with a legitimate and trustworthy organization or institution.

This requirement is common in loan applications and other financial transactions where the borrower’s income plays a crucial role in determining their eligibility and creditworthiness. By submitting recent pay slips, the lender can verify the applicant’s income, employment status, and ability to repay the loan, contributing to a more accurate assessment of the borrower’s financial situation.

When you apply for refinancing, the new lender will typically request the most recent statements for all your existing loans that are held with other finance companies or banks. These statements provide a detailed overview of your current loan obligations, including outstanding balances, repayment terms, interest rates, and payment history.